MARKET REPORTS

|

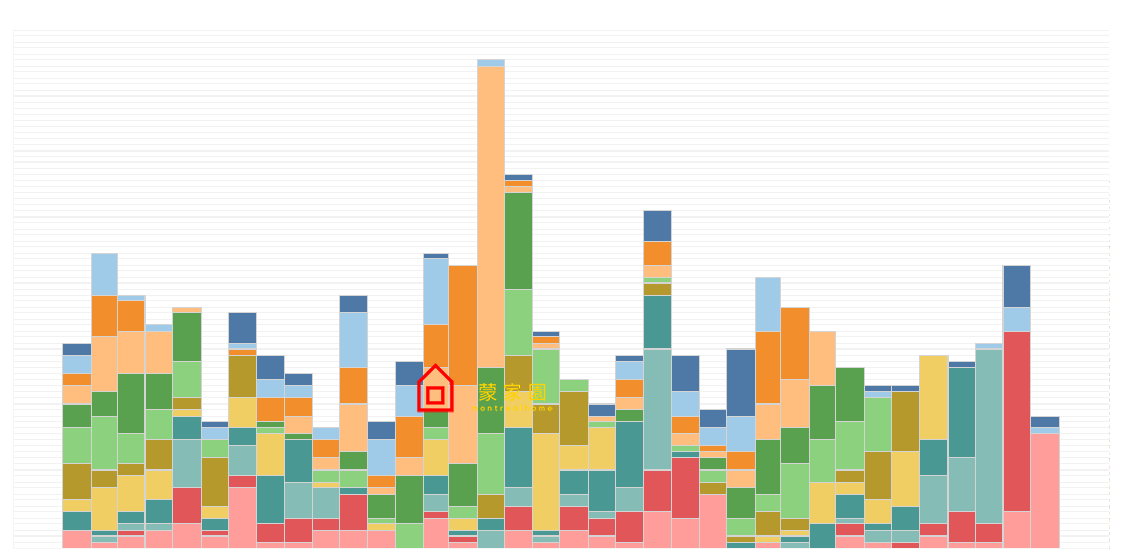

Brossard Houses Price Indicators

|

BROSSARD HOUSES PRICE INDICATORS

Many people ask how to tell whether the market is heating up or cooling down. To them I say — always listen to the brokers. Not literally, of course! What you should listen for is the variance in what they’re saying to buyers versus sellers. If you’re a seller and you want to get a good read, pretend to be a buyer. Talk to the brokers and try to bid. They will almost instantly tell you how flexible the list price is. If they tell you they think they can close it at 20% less, this is a genuine indication for what’s truly going on. In a truly hot market, sale happens close to the list price or asking price, sometimes over it. In a cooling market, this gap becomes larger, leading to deals simply not closing.

|

|

|

|

|

|

|

BUYER'S MARKET

A Sales to-Listings (SLR) ratio under 40 per cent where new listings overtake sales suggests a buyer’s market, between 40 and 60 per cent is a balanced market and over 60 per cent, where demand exceeds supply, is a seller’s market.

Absorption Rate

Absorption rate above 20%: seller's market Absorption rate below 15%: buyer's market Months Of Inventory

0-4 months: seller's market 5-8 months: balanced market 9 and more months of inventory: buyer's market |

|

|

BUY BROSSARD CONDOMINIUMS

Inventory Methodology

Methodology

Each quarter Montrealhome’s Inventory and Price Watch provides two metrics: (1) the number and share of inventory that are starter homes, trade-up homes, and premium homes, (2) the change in share and number of these homes.

We define the price cutoffs of each segment based on home value estimates of the entire housing stock, not listing price. For example, we estimate the value of each single-family home and condo and divide these estimates into three groups: the lower third we classify as starter homes, the middle third as trade-up homes, and the upper third as premium homes. We classify a listing as a starter home on the market if its listing price falls below the price cutoff between starter and trade-up homes. This is a subtle but important difference between our inventory report price points and others. This is because the mix of homes on the market can change over time, and can cause large swings in the price points used to define each segment. For example, if premium homes comprise a relatively large share of homes for sale, it can make the lower third of listings look like they’ve become more expensive when in fact prices in the lower third of the housing stock are unchanged.

For our inventory metrics, we count the number of unique listings in each price tier throughout the course of a month. We use replaced monthly counts because it is less sensitive to demand in volatile markets.

Price is now based on the median listing price of every active for sale listing throughout the month and are not comparable with previous quarters’ metrics.

Each quarter Montrealhome’s Inventory and Price Watch provides two metrics: (1) the number and share of inventory that are starter homes, trade-up homes, and premium homes, (2) the change in share and number of these homes.

We define the price cutoffs of each segment based on home value estimates of the entire housing stock, not listing price. For example, we estimate the value of each single-family home and condo and divide these estimates into three groups: the lower third we classify as starter homes, the middle third as trade-up homes, and the upper third as premium homes. We classify a listing as a starter home on the market if its listing price falls below the price cutoff between starter and trade-up homes. This is a subtle but important difference between our inventory report price points and others. This is because the mix of homes on the market can change over time, and can cause large swings in the price points used to define each segment. For example, if premium homes comprise a relatively large share of homes for sale, it can make the lower third of listings look like they’ve become more expensive when in fact prices in the lower third of the housing stock are unchanged.

For our inventory metrics, we count the number of unique listings in each price tier throughout the course of a month. We use replaced monthly counts because it is less sensitive to demand in volatile markets.

Price is now based on the median listing price of every active for sale listing throughout the month and are not comparable with previous quarters’ metrics.

Metrics

QUARTER statistics for sales and prices are for accepted sales, not closed sales once data are available for the full quarter period. Accepted sales are buyers and sellers sale agreements to be closed in a later date.

ACCEPTED AND CONTRACTS SIGNED

figures for the current quarter are based on reported transactions at the time the report is prepared and projected through the end of the quarter taking into account typical seasonality.

DAYS ON MARKET averages how

long a unit takes to sell and is calculated by subtracting contract date from list

date. Units on the market longer than three years and shorter than one day are considered outliers and removed from the data to prevent significant skewing. New developments are excluded because many available, unsold units are held off the market for long periods of time.

AVERAGE PRICE PER SQUARE FOOT

is the average price divided by the average square footage. In prior Montrealhome Reports this was calculated as an average of all prices per square foot, which gives a number less skewed by high price sales and more similar to a median price per square foot. The two metrics are now separated to give more insight to market dynamics.

MEDIAN PRICE AND PRICE PER SQUARE FOOT are the middle or midpoint price where half of sales fall below and half fall above this number.

INVENTORY is a count of all currently listed units and is measured at the last day of the end of the quarter. It includes listed units in new developments (“shadow” inventory).

MONTHS OF SUPPLY is an estimate of how long it would take to sell all currently listed units based on the average accepted sales per month over the last twelve months. Six-to-nine months is considered supply-demand equilibrium.

QUARTER statistics for sales and prices are for accepted sales, not closed sales once data are available for the full quarter period. Accepted sales are buyers and sellers sale agreements to be closed in a later date.

ACCEPTED AND CONTRACTS SIGNED

figures for the current quarter are based on reported transactions at the time the report is prepared and projected through the end of the quarter taking into account typical seasonality.

DAYS ON MARKET averages how

long a unit takes to sell and is calculated by subtracting contract date from list

date. Units on the market longer than three years and shorter than one day are considered outliers and removed from the data to prevent significant skewing. New developments are excluded because many available, unsold units are held off the market for long periods of time.

AVERAGE PRICE PER SQUARE FOOT

is the average price divided by the average square footage. In prior Montrealhome Reports this was calculated as an average of all prices per square foot, which gives a number less skewed by high price sales and more similar to a median price per square foot. The two metrics are now separated to give more insight to market dynamics.

MEDIAN PRICE AND PRICE PER SQUARE FOOT are the middle or midpoint price where half of sales fall below and half fall above this number.

INVENTORY is a count of all currently listed units and is measured at the last day of the end of the quarter. It includes listed units in new developments (“shadow” inventory).

MONTHS OF SUPPLY is an estimate of how long it would take to sell all currently listed units based on the average accepted sales per month over the last twelve months. Six-to-nine months is considered supply-demand equilibrium.